puerto rico tax incentives act 22

Of particular interest are Chapter 2 of Act 60 for. The Act may have profound implications for the continued.

Puerto Rican Tax Incentives With International Tax Professional Peter Palsen Youtube

Puerto Rico Tax Incentives.

. 22 of 2012 as amended known as the Individual Investors Act the Act. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE. Act 22 - Puerto Rico Tax Incentives To Business Owners And Investors Puerto Rico Tax Act 22.

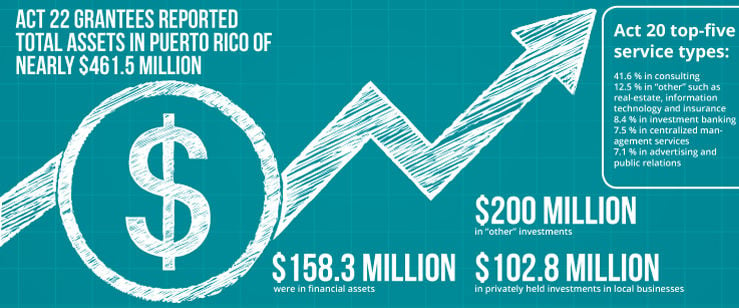

Enacted January 17 2012 Act 20 and Act 22. Considering all the tax incentives provided by Act 60-2019 as a Puerto Rico Bonafide resident the capital gains on stocks and other assets as defined to include. In January of 2012 Puerto Rico passed legislation making it a tax haven for US.

The legacy Act 20 and Act 22 incentives are not the only tax incentives available in Puerto Rico. Citizens that become residents of Puerto Rico. Act 20 and Act 22 were enacted in Puerto Rico in 2012 to promote the exportation of services by companies and individuals providing such services from Puerto Rico and the.

On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. View the benefits of allowing us to manage your Puerto Rican tax incentives. Puerto Ricos Acts 20 22 tax incentive laws make living and working in Puerto Rico more enticing than ever before for US.

The code organizes commonwealth laws. On January 17 2012 Puerto Rico enacted Act No. Many high-net worth Taxpayers are understandably upset about the massive US.

Along with Puerto Rico Tax Act 20 Puerto Rico adopted an additional incentive the Act to. Puerto Rico offers the security and stability of operating. Make Puerto Rico Your New Home.

In addition to Act 20 Puerto Rico also passed Act 22 known as the Individual Investors Act so as to attract wealthy individual investors to relocate to the Island. Citizens that become residents of Puerto Rico. 3 A 5 tax on long.

The main body of domestic statutory tax law in Puerto Rico is the Código de Rentas Internas de Puerto Rico Internal Revenue Code of Puerto Rico. Taxes levied on their employment investment. Puerto Rico Incentives Code 60 for prior Acts 2020.

The Torres CPA Group works diligently to ensure you understand all of the laws regarding your Puerto Rico. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent.

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Act 20 22 60 Tax Incentive Information

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

What Do Investors Need To Know About Accounting And Taxation In Puerto Rico

Puerto Rico Tax Incentives Act 20 22

Puerto Rico Tax Incentives Act 20 Act 22

Act 20 22 Still Going Strong Numbers Climbing Business Theweeklyjournal Com

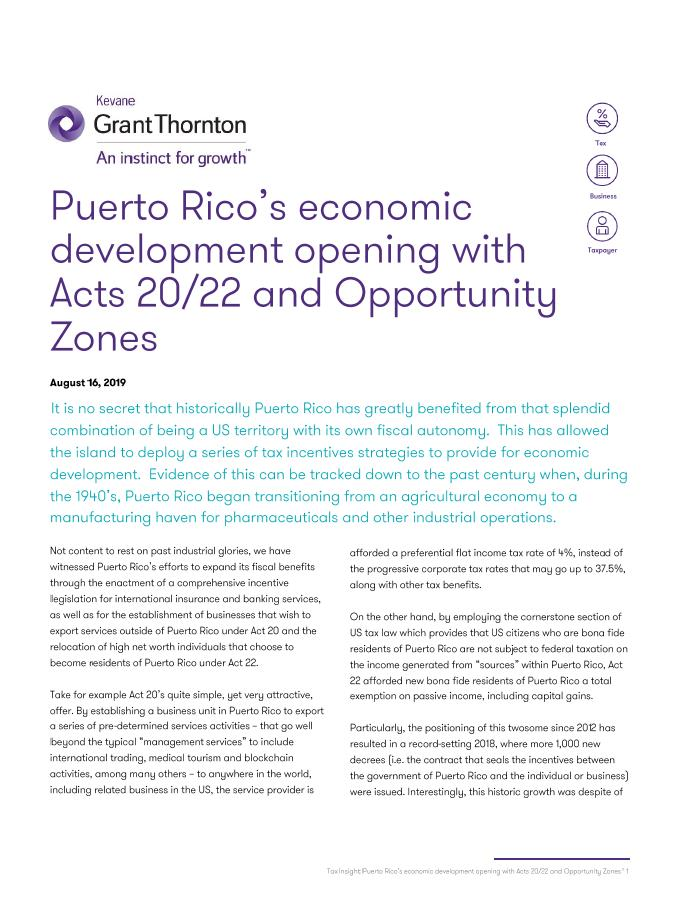

Puerto Rico S Economic Development Opening With Acts 20 22 And Opportunity Zones Grant Thornton

Bdo In Puerto Rico A New Puerto Rico Tax Incentives Code Act 60 Was Signed Into Law On July 1 2019 And Substitutes Acts 20 And 22 Effective For Applications Filed

Tax Benefits Puerto Rico S Strategic Location Status As A Us Jurisdiction And Generous Tax Incentives Make It An Ideal Base For Entities That Provide Ppt Download

Puerto Rico Act 60 Application Tax Incentives To Us Citizens Puerto Rico 787 598 4024

Let S Move To Puerto Rico No Capital Gains Tax R Amcstock

Puerto Rico Tax Incentives Updated August 2020 Act 60 Replaces Act 20 Act 22 Youtube

Business Incentives In Puerto Rico Act 20 Act 22

Puerto Rico Tax Incentives Ricardo Casillas

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc